Life Insurance

A wide variety of life insurance products are available in today’s marketplace. However, they basically fall into two categories, either temporary coverage or permanent coverage. Let’s take a look at how they differ.

Term

We understand that everyone’s situation is different; maybe you need insurance coverage while you are paying off a 30-year mortgage or for just a few years to ensure the college years are a reality if something should happen to you. Sons of Norway offers a guaranteed level term insurance policy in durations of 10, 15, 20 or 30 years. You can decide what works best for your situation and add riders to customize your coverage.

Should your situation change and you need to keep the coverage after the term expires, you can convert your policy to a permanent type of coverage or extend the time annually by simply continuing the premium payments that will be recalculated for you.

Download our educational flyer to help you learn about how a term product might fit your needs.

Permanent

Whole life can be purchased with a single one-time premium payment or with annual payments during your lifetime. Either way you will have guaranteed coverage with guaranteed cash value, and with most types you will also have the ability to earn dividends.

Whole Life

Deciding how to protect your family and loved ones is very important. There are so many types of life insurance to choose from. If you are considering permanent coverage, Sons of Norway has options designed for you. Whole life insurance provides coverage for your entire life with level premiums and a guaranteed death benefit.

Download our educational flyer to see how Whole Life Might fit your needs.

Single Premium Whole Life

If leaving a legacy for your family is important to you, there are steps you can take to ensure that the legacy you desire becomes reality and your assets pass in an efficient way. Single Premium Whole Life – an integral part of your overall wealth transfer strategy.

Download our educational flyer to see how Single Premium Whole Life might fit your needs.

LegacySure is now available in most states. This type of whole life that is perfect for those who would rather answer some simple questions not take a medical exam. They just want to know they are guaranteed to have the insurance coverage they need for final expenses or leaving a legacy.

Download our educational flyer to see how LegacySure might fit your needs.

| Benefits to consider | Term Insurance | Permanent Insurance |

|---|---|---|

| Guaranteed death benefit | Yes | Yes |

| Tax-deferred cash value accumulation | No | Yes |

| Lifetime death benefit | No | Yes |

| Riders to customize coverage | Yes | Yes |

| Simple product | Yes | No |

| Ability to earn dividends | No | Yes |

| Tax-free death benefit | Yes | Yes |

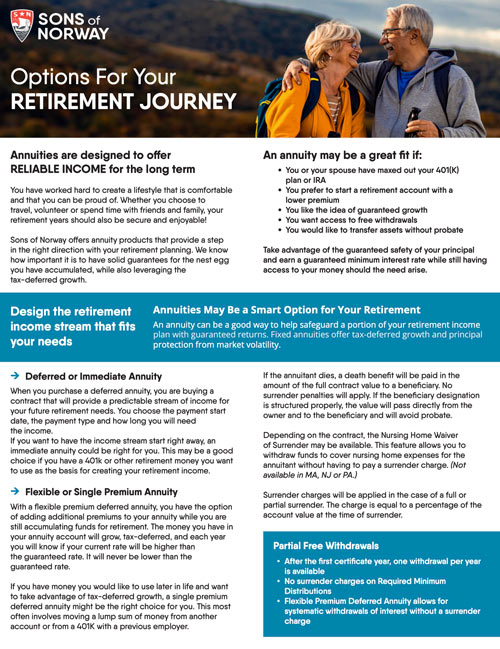

Annuities

An Annuity is an investment designed for protection from market risk while offering you a guaranteed rate of return. An Annuity is a contract between you and an insurance company. Annuities give you the option to simply let your money grow with interest, ability to access free withdrawals, or take systematic payments over a set number of years; there are even life time payment options. Annuities have many advantages:

- Tax Deferral

- Protection from Market Risk

- Diversification

- Guaranteed Interest Rate

- Access to Free Withdrawals

With the right Annuity, Sons of Norway can help you reach your long-term financial goals.

Download our educational flyer to help you learn about how an annuity might fit your needs. Here are the current rates available from Sons of Norway download our rate sheet.

| Immediate | Deferred | Bonus |

|---|---|---|

| With an immediate annuity you can begin payments as little as 30 days after purchase. This type of Annuity is ideal for people who are about to retire and want a predictable income stream. |

A Deferred Annuity promises to pay the owner a guaranteed interest rate and can provide the owner with an income stream, or a lump sum, after the duration of the contract. Sons of Norway of Norway offers 5- and 8-year durations. |

Bonus Annuities can be a powerful tool in your retirement plan. A bonus annuity can help you boost your retirement plan and give you options, all with zero fees. The amount of the bonus is determined by the deposit amount at time of purchase.

|

Let’s talk about what type of life insurance will meet your personal needs: A Sons of Norway Insurance Professional can help!

Any distributions are subject to ordinary income and tax, if taken prior to age 59 1/2, a 10% federal additional tax.

All guarantees are backed by the claims-paying ability of the issuing company.

Sons of Norway and its distributors and representatives do not provide tax, accounting, or legal advice. Please consult your own attorney or accountant.